Wetherspoon's (JDW) competitive advantage

Hard-to-replicate business model but facing industry challenges

JD Wetherspoons (JDW) is probably the most famous chain of pubs in the UK. The company’s innovative and hard-to-replicate business model has made them a success right from the start, though the current challenges of the industry are threatening to undermine its franchise value. In this article, we will look deeper into the sources of Wetherspoon's advantage and what the future is likely to hold for them.

Wetherspoon’s was founded in 1983 by Tim Martin, who named the company after his school teacher who had told him that he would never amount to anything. Martin decided to prove his teacher wrong by building a successful business. He chose the high-volume, low-margin approach inspired by McDonald’s to achieve his goal and it has worked like magic.

The Spoons became known for their unrivalled value. Students, builders and all the other cost-conscious types flock there to get their burger and a pint fix for a price that’s probably 20-30% less than the competition. It is a combination of factors that enables them to be a price leader in the industry.

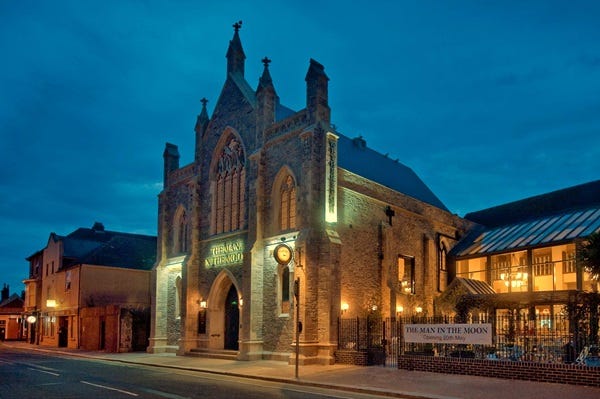

First, Wetherspoons operates the largest pubs in the UK. The average size of a J.D. Wetherspoon typically ranges from around 5,000 to 10,000 square feet, whereas the average size of a British pub is only 1,800 square feet. With the highest sales per pub in the industry, JDW is able to leverage fixed costs over the largest number of units sold and thus incur the lowest cost per unit.

Second, Wetherspoons is willing to share cost savings with its customers. Even though JDW has the lowest cost structure in the industry it also has one of the lowest operating margins as well. Instead of monetising its operating costs advantage, the Spoons are choosing to invest in their brand equity. Nowadays the Brits seem to be convinced that Wetherspoons offers the best value in the industry.

Third, their pubs are located in high footfall, high catchment areas. Size by itself would not be important if only a limited number of customers frequented the pub. Favourable locations provide a large enough pool of potential customers to keep large pubs busy and the brand equity lures passers-by to come in.

The three factors come together to form a rather formidable moat, which would be hard to replicate for anybody. The local catchment areas of the pubs do have saturation rates. Since the model relies on a rather high minimum efficient scale, a lot of the areas can support only one super pub. It is hard to see any other competitor moving into an area where Wetherspoons already staked their claim. The maturity of the pub industry reinforces this dynamic.

JD Wetherspoons is a well-entrenched business unfortunately this is not the full picture. The number of pubs that Wetherspoons owns peaked in 2015 but declined by 11% since then. The operating margin of the business was also declining continuously, from about 10%+ in 2009 to 7%+ in 2019. Something is clearly burdening the business and we need to find out what.

We have identified a number of headwinds that the business is facing and analysed each one of them thoroughly. It is beyond the scope of this article to present the findings of this research, but some of the most important issues that we analysed were:

Tax inequality with off-trade.

Inflation of labour costs.

Squeeze on disposable income.

Changing consumer preferences.

We would be happy to discuss our research findings, - all you have to do is reach out!